Beyond the baseline: Why sustainable supply chains are the key to AR7 and AR8 success

menu opisówka

The UK has set one of the most ambitious offshore wind targets in the world: 50GW by 2030, rising further by 2050. Coming close to meeting this goal will require strong, sustainable supply chains to make the transition both achievable and aligned with climate targets.

To encourage the required investment to build and sustain those supply chains, the UK government has introduced the Clean Industry Bonus (CIB) in Allocation Round 7. This marks a clear change of direction, so what do the new rules demand in practice?

The criteria era

To qualify for the floor, developers must commit substantial sums, for example £100 million per gigawatt of fixed-bottom capacity, into UK supply chains: specifically manufacturing facilities, ports or installation firms in government-designated deprived areas or procure from suppliers with approved SBTi targets. The framework also rewards those who go further, with additional CfD revenues available for projects that exceed the baseline, with up to around £27 million of extra support per gigawatt available for the strongest proposals.

This marks a clear step change from previous rounds and the first stages of a new direction of travel. Allocation Round 8 is widely expected to further environmental and social requirements, and the bar is only going to rise from here. Some elements of meeting these new demands will be challenging for both developers and their partners, but supply chains must be ready to help generators qualify. The government has guaranteed this investment to an extent by making it part of the rules, and it has backed that up with clear incentives. The real question now is how supply chains both align with the floor and help generators go beyond it, tapping into the additional revenues on offer and working together to build the world-class domestic supply chain the UK needs to deliver its offshore wind ambitions.

Science-based targets are essential

One answer to that question lies in setting science-based targets that align with recognised global frameworks. The Science Based Targets initiative (SBTi) remains the most established and widely adopted option, forming part of the CIB floor criteria, where developers now need partners with independently verified targets. For many supply chain companies this can feel daunting because it demands data they’ve never gathered historically and a different way of understanding their operations.

But even prior to the introduction of the CIB, the setting of targets was moving closer into being an expectation. By 2023, according to the SBTi’s monitoring report, 693 UK companies had validated targets, more than double the year before, showing that the CIB has only turned what was already a growing expectation into a hard requirement.

While aligning with and setting science-based targets isn’t straightforward, it is eminently achievable for most supply chain companies. In practice it means measuring energy use across sites, logistics emissions and upstream supplier activity, building a consistent baseline, setting near and long-term reduction targets, submitting them for independent validation and then wiring that plan into governance, reporting and procurement.

At JDR, the process was challenging but valuable. It revealed quick changes we could make immediately such as improving energy efficiency in our facilities and tightening logistics, as well as larger shifts like redesigning processes and engaging material suppliers more closely. It has also made climate considerations a permanent part of our strategy. Those who begin their science-based targets journey now and build credible systems around it will be the best prepared as expectations tighten in AR8 and later rounds.

Engaging your own supply chain

Science-based targets alignment does not stop at your own operations. Because most emissions for companies such as ours sit in scope 3, the framework requires companies to work with their suppliers as well. At JDR, we’ve mapped out a pathway from 2022 to Net Zero by 2050. The striking thing is that our own direct emissions (scope 1 and 2) are a tiny slice of the pie. Almost 99% of our footprint comes from scope 3, with more than half of that sitting in our supply chain. Continued progress and validation depend on those partners beginning the same journey. Not all are ready yet, but the direction of travel means more and more will be expected to set and deliver on their own targets.

At JDR, we have already started extending the process to our partners, as they are ultimately a massive part of the solution both for us and our own customers. The point is ultimately to strengthen and decarbonise the whole domestic ecosystem. Offshore wind depends on every part of that chain and helping one another to move faster will decide how resilient the sector becomes as requirements tighten in AR8 and beyond.

UK-based advantages

Just as science-based targets alignment and supplier engagement are becoming non-negotiable, investment in domestic manufacturing, ports or installation capacity is now also a core part of meeting the CIB floor. At present, generators can qualify by doing one or the other but in future rounds, developers may well be expected to demonstrate both as the baseline for eligibility.

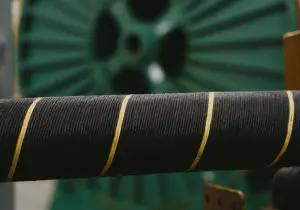

The goal is to build long-term capacity for the components that matter most to offshore wind. Subsea cables are a prime example: essential for carrying clean power to the grid, yet until recently the UK had limited ability to produce them at the required scale or voltage for offshore wind. That is changing with new facilities coming online. JDR’s new site at Blyth, supported by government funding, will be the UK’s first to deliver full end-to-end manufacturing of high and extra-high voltage subsea cables, essential for connecting the next generation of projects.

Of course, not every supplier will build a new facility of that scale. What matters is that UK capacity and stronger supply chains are in place where they are most needed. The CIB means generators are now required and rewarded to support the domestic supply chain, giving suppliers the certainty to expand. It is mutually beneficial and when paired with SBTi alignment it forms the mix that defines a bid that meets the floor for today and prepares the ground for tomorrow.

Social at the centre

The same logic applies to social value. Social requirements are already visible in AR7, where the CIB directs investment into deprived areas. AR8 is expected to go further, with stronger focus on skills and fair work that will make social value a more central part of the framework. For supply chain companies this means showing how investment creates jobs, supports training and develops opportunities.

It is not only about meeting CIB criteria but about tackling the wider skills challenge the industry faces. According to the Wind Industry Skills Intelligence Report 2025 from OWIC and RenewableUK, there are currently almost 40,000 people working in offshore wind, but meeting government targets will require 75,000 by 2030. The gap is clear, and it is in everyone’s interest that these skills are developed.

At JDR, we have invested in apprenticeships, training programmes, student placements and partnerships with local colleges and the Energy Central Campus in the North East. These are not new initiatives, but they illustrate the kind of long-term commitment that will be expected more widely. As AR8 and beyond place greater weight on social value, and with such a significant skills gap ahead, every company in the supply chain will need to contribute. Those that do will not only strengthen local economies but also give developers the evidence they need to for bidding rounds.

From compliance to competitiveness

The introduction of the CIB means sustainability will only get more important from here. AR7 has set a new baseline, and AR8 will raise the bar again with tougher environmental and social requirements. Sustainability has become a business-critical issue. Our customers are under immense pressure to decarbonise. That pressure flows directly to us as their supplier, and in turn onto our own supply chain.

The message is simple: if we want to remain competitive and attractive, we need to demonstrate real progress on our carbon footprint.

For supply chain companies this creates both a challenge and an opportunity. By setting science-based targets, investing in UK capacity and showing real social impact, suppliers won’t just help developers qualify, they’ll make themselves more valuable partners. Those who act early will stand out, open doors to new contracts and strengthen the sector as a whole.

By Elgan Hallett,

Sustainability Manager,

JDR Cable Systems